If you share the same last name with other stockholders living in your household, you may receive only one copy of our Notice of Annual Meeting and Proxy Statement and accompanying documents. Please see the response to the question “What is ‘householding’ and how does it affect me?” in the Questions and Answers About the Annual Meeting and Voting section for more information on this stockholder program that eliminates duplicate mailings.

INFORMATION CONCERNING DIRECTORS

Currently, the Board of Directors (the “Board”) of the Company consists of

10ten directors whose terms expire at the

20232024 Annual Meeting of Stockholders (the “Annual Meeting”). Our Board has nominated the current

10ten directors for

re-election at the Annual Meeting.

BOARD STRUCTURE

•The Board is fully declassified and all directors stand for re-election annually. | • | | The Board is fully declassified and all directors stand for

•re-election annually; and |

The Company’s ThirdFourth Amended and Restated Bylaws (the “Bylaws”(“Bylaws”) provide for majority voting in uncontested director elections, with a resignation requirement for directors not elected by a majority vote. Directors will be elected by a majority of votes cast at the Annual Meeting. Each person elected at the Annual Meeting will serve until the 20242025 Annual Meeting of Stockholders and until his/her successor is duly elected and qualified.

Your proxy will vote for, against, or abstain for any director. If you properly execute and date your proxy card but do not indicate how you want your proxy voted, it will be voted for each of the

10ten nominees unless you specifically vote against any of the nominees or abstain from voting with respect to a director’s election. Pursuant to our Bylaws, majority of votes cast means that the number of shares voted “for” a director’s election exceeds 50% of the number of votes cast with respect to that director’s election. “Votes cast” shall include votes against a director and shall exclude abstentions and broker

non-votes with respect to a director’s election. If any nominee is unable to serve, the named proxy may vote for another nominee proposed by the Board. We do not know of any nominee of the Board who would be unable to serve if elected.

DIRECTOR QUALIFICATIONS, SKILLS, AND EXPERIENCE

Pursuant to the Corporate Governance Guidelines adopted by our Board, nominees for director are selected on the basis of, among other things, experience, knowledge, skills, expertise, mature judgment, acumen, character, integrity, diversity, ability to make independent analytical inquiries, understanding of the Company’s business environment, and willingness to devote adequate time and effort to Board responsibilities. The Board believes that each of the current directors and nominees for director exhibit these characteristics.

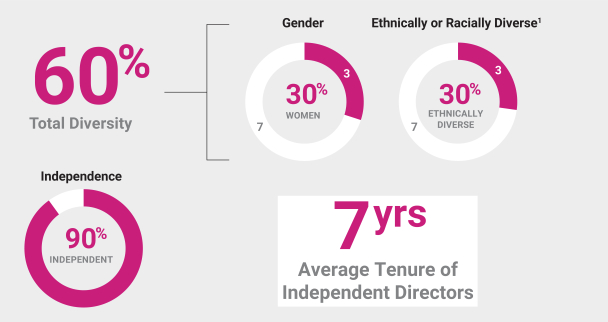

As mentioned above, diversity is considered in the selection of director nominees. In this context, “diversity” includes gender, race, ethnicity, nationality, national origin, or other elements of one’s identity. In addition, the Governance and Nominating Committee is committed to including, in each third-party search for independent director candidates, qualified candidates who reflect diverse backgrounds, including diversity of gender and race. We are proud of our record on diversity, including at the Board level, and are likewise proud of our commitment to personal privacy. As a result, while we inquire of our directors and nominees about certain attributes relating to diversity, each individual may choose to respond or not to such inquires. Therefore, our diversity statistics may not represent all elements of diversity included on our Board.

| | | | | | | | |

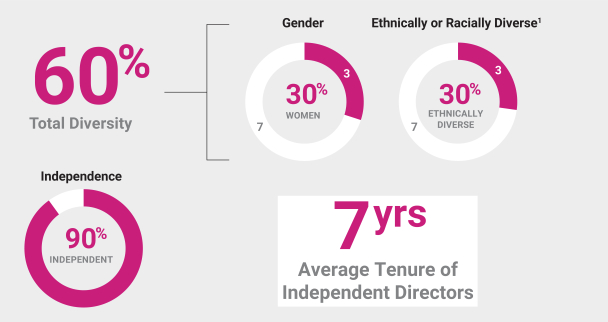

60% Total Diversity Through self-identification in director questionnaires.

| | |

| |

| |

| | | | | | | | | | | | | | | | | |

| 8yrs | Average Tenure

of Independent Directors | | 90% | Independent Directors |

Our director nominees have experience in various roles, and they include current and former Chief Executive Officers, Chief Financial Officers, consultants, investment professionals, and other executives. Many possess experience as directors, having served on the boards and board committees of public or private companies. The director nominees have experience in a variety of industries, including manufacturing, financial, information technology, professional services, cybersecurity, and others. Furthermore, the nominees collectively possess a broad array of skills that the Board has deemed relevant to the Company’s strategy.

Set forth in the following Board of Directors

SkillSkills Matrix

(“Matrix”) and with each director’s biographical information is a description of the key qualifications, experience, skills, and expertise that led the Board to the conclusion that such individuals should serve as the Company’s directors.

5

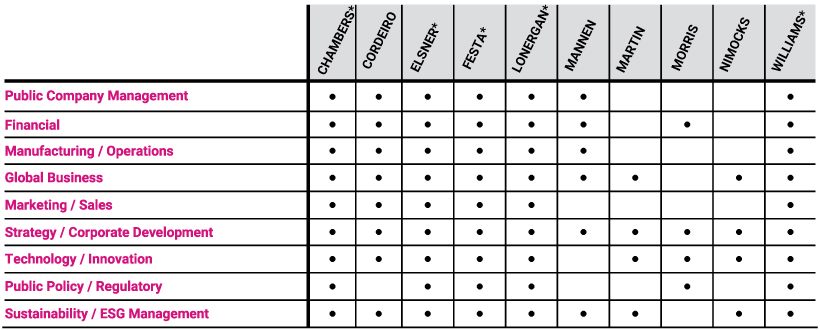

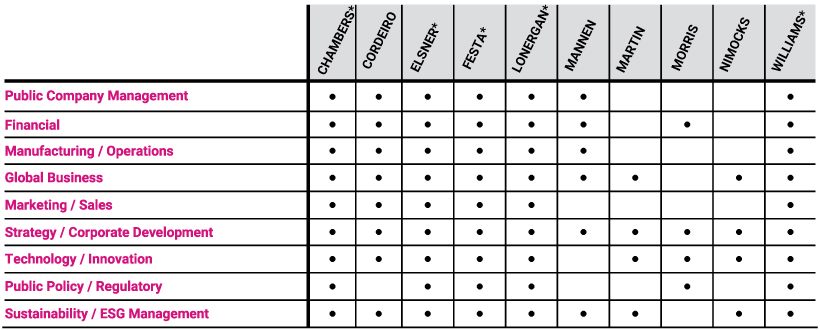

BOARD OF DIRECTORS SKILLSKILLS MATRIX

The categories included in the

Skills Matrix are tied to the Company’s strategy, and the goal is that the directors collectively possess qualities that facilitate their effective oversight of the Company’s strategic plans. While the

Skills Matrix is useful for determining the collective skills of the Board as a whole, it is not a comparative measure of the value of directors; a director with more focused experience could nonetheless contribute broadly and effectively.

The

Skills Matrix identifies the principal skills that the Governance and Nominating Committee considered for each director when evaluating the director’s experience and qualifications to serve as a director. Each

“●” mark

● indicates an experiential strength that was self-selected by each director.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Public Company Management | l | l | l | l | l | l | | | | l |

| Financial | l | l | l | l | l | l | | l | | l |

| Manufacturing / Operations | l | l | l | l | l | l | | | | l |

| Global Business | l | l | l | l | l | l | l | | l | l |

| Marketing / Sales | l | l | l | l | l | l | | | | l |

| Strategy / Corporate Development | l | l | l | l | l | l | l | l | l | l |

| Technology / Innovation | l | l | l | l | l | l | l | l | l | l |

| Public Policy / Regulatory | l | | l | l | l | l | | l | | l |

| Sustainability Management | l | l | l | l | l | l | l | | l | l |

*Current or previous experience as a Chief Executive Officer (“CEO”).

6

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR EACH DIRECTOR NOMINEE NAMED IN PROPOSAL 1.

Nominees for Election as Directors for a Term Expiring at the

20242025 Annual Meeting of Stockholders

| | | | | | | | |

BRIAN D. Committee

Membership(s): Other Public Boards: ••Lincoln Electric

Holdings, Inc. (Nasdaq:(Nasdaq: LECO)

| | Mr. Chambers is Board Chair, President, and Chief Executive Officer atof the Company. He was appointed CEOChief Executive Officer in 2019 and elected Board Chair in 2020. He previously served in several senior leadership roles at the Company, including President and Chief Operating Officer from 2018 to 2019, President of the Roofing business from 2014 to 2018, Vice President and General Manager of Roofing from 2013 to 2014, and Vice President and General Manager inof the Composites business from 2011 to 2013. In total, Mr. Chambers has over 1920 years of global business and leadership experience with the Company. He also previously held several commercial and operational roles outside the Company at Saint Gobain, Honeywell, and BOC Gases. Since February 2022, Mr. Chambers has served on the Board of Directors of Lincoln Electric Holdings, Inc., a world leader of engineering, design, and manufacturing of advanced arc welding solutions, automated joining, assembly and cutting systems, plasma and oxy-fuel cutting equipment, and is a member of its Audit and Finance Committees. Mr. Chambers is a member of the Business Roundtable and is on the executive committees of the Ohio Business Roundtable and the Policy Advisory Board of the Joint Center for Housing Studies of Harvard University.

Key Qualifications, Experience, Skills, and Expertise Contributed to the Board Mr. Chambers brings to the Board a thorough understanding and extensive knowledge of the Company’s people, products, and markets worldwide gained through his key leadership positions in the Company. In these roles, especially as the current Chief Executive Officer and Board Chair of the Company, he playedplays an integral role in developing the Company’s strategies, which has helped to provide the foundation for the current direction of the Company. Mr. Chambers possesses a significant understanding of, and experience with, complex operations as well as company-specific customer expertise that drive the Company toward achievement of its expansion and growth goals. This industry-specific experience and breadth of knowledge enable him to provide the Board with a unique, invaluable perspective. In addition, Mr. Chambers’ extraordinary leadership qualities as well as the ability to identify and develop those qualities in others facilitate the Company’s strategic growth execution. Mr. Chambers’ deep connection to understanding the operations and products of the Company empower him to foster material innovation on the Company’s pathmission to building a sustainable future. We believe that Mr. Chambers’ experience and focus on sustainability has led the Company to increase its percent of revenue that comes from its portfolio of products that save energy or reduce emissions. He is dedicated to science-based targets that align with the Company’s aspiration to be a net-positive company. Mr. Chambers’ vast knowledge of material products also allow him to understand and successfully execute key strategies to expand the Company’s products’ handprint and positive impacts worldwide. His experience serving on a publicly traded company board provides him with additional global business perspective and further deepens his leadership and strategy skills.

|

| | |

7

| | | | | | | | |

Committee Membership(s): • Compensation•

Finance (Chair)

Other Public Boards: ••FMC Corporation

(NYSE: FMC)

| | Mr. Cordeiro served as Executive Vice President, Chief Financial Officer at Cabot Corporation, a global specialty chemicals and performance materials company, from 2009 to 2018. He also served2018 and as President of the Americas region from 2014 to 2018. During his 20-year tenure at Cabot, he held several corporate, business, and executive management positions, including Vice President of Corporate Strategy and General Manager of its Fumed Metal Oxides and Supermetals businesses. Prior to his career at Cabot, Mr. Cordeiro was a consultant with The Boston Consulting Group and a founding partner of The Economics Resource Group. He has also served on the Board of Directors of FMC Corporation, a public multinational company serving agricultural, industrial, and consumer markets, since 2011 and chaired its Audit Committee since 2014.

Key Qualifications, Experience, Skills, and Expertise Contributed to the Board Through Mr. Cordeiro’s broad range of corporate, business, and executive management roles at Cabot and The Boston Consulting Group, he gained significant corporate strategic operations expertise that allows him to provide the Board with a meaningful perspective on the Company’s operations and strategy. His experience in a complex global industrial business focused on chemicals and specialty materials complements the Company’s strategy to expand into new product adjacencies. During his multiple finance roles at Cabot throughout his twenty-year career, including, most recently, the Chief Financial Officer position, Mr. Cordeiro gained extensive financial expertise and significant knowledge of capital markets, and accounting systems and controls that enable him to provide the Board with a meaningful perspective on matters relevant to the Company’s growth strategy and capital deployment. His financial background is especially insightful in his role as chairChair of the Finance Committee. Additionally, Mr. Cordeiro’s experience from serving as director and chair of the Audit Committee for FMC Corporation augments the risk management and financial reporting knowledge of the Board.

|

| | |

8

| | | | | | | | |

Committee Membership(s): Other Public Boards: ••Benson Hill, Inc.

(NYSE: BHIL)

| | Ms. Elsner currently serves as Chief Executive Officer of Benson Hill, Inc., a food technology company, since October 2023, and on its Board of Directors since 2019. Ms. Elsner served as Interim Chief Executive Officer of Benson Hill from June 2023 to October 2023. Prior to that, she served as President, Chief Executive Officer, and a director of Charlotte’s Web Holdings, Inc., a leader in hemp-derived CBD extract products, from 2019 to 2021. From 2015 to 2018, she served as President, U.S. Snacks, Kellogg Company, a manufacturer and marketer of convenience foods. From 1992 to 2015, Ms. Elsner served in several increasingly senior positions, including Executive Vice President, Chief Marketing Officer with Kraft Foods, Inc., a multinational confectionery, food and beverage conglomerate. Ms. Elsner serves on the Board of Directors of Benson Hill, Inc., a food technology company. She has also served on the board of the Ad Council.

Key Qualifications, Experience, Skills, and Expertise Contributed to the Board Ms. Elsner’s experience as the current Chief Executive Officer of Benson Hill and former Chief Executive Officer of Charlotte’s Web provides the Board with diverse perspectives on strategy and growth across a range of industries. Through her broad range of leadership positions at Kellogg Company and Kraft Foods, especially as Chief Marketing Officer, Ms. Elsner gained significant knowledge of global markets and operations, and extensive sales, strategy, and product innovation in domestic and international markets. This breadth of experience enables her to provide the Board with a valuable perspective as the Company focuses on strengthening its position in core markets, building its brand, and strengthening its distribution and home centers relationships. Ms. Elsner’s unique appreciation of customers, shareholders, and employees parallels and propels the Company’s goal to enhance its social impact through commitments to health and safety, inclusion and diversity, and its communities. Ms. Elsner’s broad financial and operating experience as CEOa Chief Executive Officer of a public companycompanies and leading sizeable domestic and international business units of large public companies provides valuable insight for the Company as it continues to operate globally in over 3130 countries. Her leadership roles at Benson Hill, Charlotte’s Web, Kellogg Company, and Kraft Foods Inc., and her experience as a director for other public companies enable Ms. Elsner to provide unique and valuable contributions to the Board in the areas of global management and business strategy. Ms. Elsner’s extensive experience overseeing financial processes and understanding of finance led to her designation as an “audit committee financial expert.”

|

| | |

9

| | | | | | | | |

Committee Membership(s): Other Public Boards: ••NVR, Inc.

(NYSE:(NYSE: NVR)

| | Mr. Festa has served as an Operating Advisor at Clayton, Dubilier & Rice, a global private equity firm with a broad portfolio, since 2020. Mr. Festa served as Chairman and Chief Executive Officer of W.R. Grace & Co., a leading global producer of specialty chemicals and materials, from 2008 to 2018, and non-executive Chairman from 2018 to 2019. He joined W.R. Grace as President and Chief Operating Officer in 2003 and assumed the role of CEOChief Executive Officer in 2005. Previously, he served in senior leadership positions at Morgenthaler Private Equity Partners and AlliedSignal (now Honeywell). He began his career at General Electric, where he spent 12 years in financial management positions. He also serves on the Board of Directors of NVR, Inc., a public homebuilding company, since 2008, and serves on its Audit and Nominating and Corporate Governance Committees.

Key Qualifications, Experience, Skills, and Expertise Contributed to the Board Mr. Festa developed an in-depth understanding of materials manufacturing, brand marketing, and financial expertise through his many leadership positions at a leading global producer of specialty chemicals and materials. This expertise and his extensive management experience provide the Board with a valuable, independent perspective on the Company’s global manufacturing operations. As a top executive of a public company, Mr. Festa’s global operating experience, particularly related to mergers and acquisitions, strong financial background, and proven leadership capabilities are especially important to the Board’s consideration of product expansion into new product adjacencies that leverage market and manufacturing expertise. Mr. Festa’s public company board experience at a homebuilding company allows him to contribute to the Company’s strategy and provide a voice of the customer. In addition, his experience from serving as a director and a member of the Audit Committee and Nominating and Corporate Governance Committee of NVR helps support the Company’s goals of strong Board governance and business ethics.

|

| | |

10

| | | | | | | | |

Committee

Membership(s): • Compensation (Chair)

•

Governance and Nominating

Other Public Boards:

| | Mr. Lonergan has served as Executive Chairman of Zep Inc., an international provider of maintenance and cleaning solutions to the commercial, industrial, institutional, and consumer markets, since 2015. Prior to joining Zep Inc., Mr. Lonergan served as Chief Executive Officer of Chiquita Brands International, Inc. from 2012 until the privatization of the company in 2015. He served as Chief Executive Officer of Diversey, Inc. from 2006 through the sale of the company in 2011. Prior to Diversey, Mr. Lonergan served as President, Europe for Gillette from 2002 through its sale in 2006. Between 1981 and 2002, he held a variety of leadership positions both domestically and internationally at the Procter & Gamble Company, including general management roles in customer business development and in emerging markets. He was Chairman of DRB Systems, Inc. until its sale in 2021 and was a member of the Board of Directors of The Schwan Food Company from 2014 through its sale in 2019. He has served as a Senior Advisor at New Mountain Capital (“NMC”), a private equity company, since 2017, and, in addition to Zep Inc., serves on the Board of Directors of NMC portfolio company Summit Wash Holdings since 2022.

Key Qualifications, Experience, Skills, and Expertise Contributed to the Board As the current Executive Chairman of Zep, Inc. and as the former Chief Executive Officer of Chiquita Brands International and Diversey, Mr. Lonergan’s executive experience and management and operation skills provide valuable knowledge to the Board related to the Company’s business operations and associated risks, both domestic and international. The broad executive-level financial and strategic experience with several publicly traded companies provides valuable insight for the Board as to the issues and opportunities facing the Company. As the Company looks to expand into new product adjacencies that leverage market and manufacturing expertise, the Board leverages Mr. Lonergan’s extensive knowledge of global manufacturing and strong strategic and financial management expertise, as well as his keen understanding of both the business to business and consumer products industries.

|

| | |

11

| | | | | | | | |

Committee

Membership(s): •Governance and

Nominating

Other Public Boards: ••MPLX LP* (a limited

partnership formed by Ms. Mannen’s current employer, Marathon Petroleum) (NYSE: MPLX)

| | Ms. Mannen currently serves as President of Marathon Petroleum Corporation, a leading, integrated, downstream energy company, since January 2024. From 2021 to January 2024, she was the Executive Vice President and Chief Financial Officer of Marathon Petroleum Corporation, a leading, integrated, downstream energy company.Petroleum. From 2017 to January 2021, she was the Executive Vice President and Chief Financial Officer of TechnipFMC (a successor to FMC Technologies, Inc.), a global leader in subsea, onshore/offshore, and surface projects for the energy industry. From 2014 to 2017, she served as Executive Vice President and Chief Financial Officer of FMC. Previously, Ms. Mannen served in several roles of increasing importance at FMC, including Senior Vice President and Chief Financial Officer. Prior to joining FMC in 1986, Ms. Mannen served as Finance Manager for Sheller-Globe Corporation. She currently serves on the Board of Directors of MPLX LP, a diversified, large-capital master limited partnership formed by Marathon Petroleum Corporation that owns and operates midstream energy infrastructure and logistics assets, and provides fuels distribution services.

Key Qualifications, Experience, Skills, and Expertise Contributed to the Board Ms. Mannen’s well-rounded management experience at leading public companies in the energy sector, including her current experience as President of Marathon Petroleum, with oversight of the largest refinery in the U.S., enables her to contribute important insights to the Board regarding international business strategy and management of public companies. As the Company navigates expansion, Ms. Mannen’s extensive executive-level experience in the energy sector benefits the Board by providing significant knowledge and guidance on revenue markets regarding the Company’s three integrated businesses. Additionally, Ms. Mannen’s role as President of Marathon Petroleum, which includes oversight responsibilities for matters related to health, environment, safety and security, provides the Board with additional insights into the Company’s sustainability strategy and initiatives. As the currentformer Chief Financial Officer of Marathon Petroleum and former Chief Financial Officer of TechnipFMC, she brings extensive financial and risk management experience to the Board, which is important as the Company navigates growth and strengthens its core markets. Ms. Mannen’s financial expertise and strong knowledge of accounting systems and controls enable her to provide the Board and management with strong oversight of the management of the Company’s assets and specifically in her role as chairChair of the Audit Committee. Ms. Mannen’s financial management experience and extensive knowledge of accounting led to her designation as an “audit committee financial expert” and Chair of the Company’s Audit Committee. *Our Board views Ms. Mannen’s service on the board of MPLX LP, which is a wholly-owned subsidiary of Ms. Mannen’s current employer, as an extension of her senior executive role with its parent company and not as a separate outside board because her responsibilities substantially overlap and require minimum extra work to her current responsibilities as CFO of Marathon.at Marathon Petroleum. For more information, see the “Director Service on Other Public Boards (Overboarding Policy)” section of this Proxy Statement.

|

| | |

12

| | | | | | | | |

Committee

Membership(s): Other Public Boards: ••Unisys Corporation

(NYSE: UIS)

•STERIS plc. (NYSE:(NYSE: STE)

| | Mr. Martin served as Senior Vice President and Chief Information Officer for Baxter International Inc., a multinational health care company, from 2011 to 2020. Prior to Baxter, Mr. Martin served as Global Chief Information Officer from 2004 to 2011 at Rexam plc, a consumer packaging manufacturing company based in the U.K., where he also held several key senior management positions from 1999 to 2004, including head of information technology for American National Can Group Inc. (acquired by Rexam). Prior to his career at Rexam, Mr. Martin held information technology leadership positions at the CIT Group Inc., BNSF Railway Company, and Frito-Lay, Inc. Since 2017, Mr. Martin has served on the Board of Directors of Unisys Corporation, a publicly traded global information technology company, and is currently a member of its Audit and Finance Committees as well as the Chair of the Security and Risk Committee. Also inIn 2021, Mr. Martin joined the Board of Directors of STERIS plc., a leading provider of infection prevention and other procedural products and services, and is a member of the Compliance and TechnologyAudit Committee and Compensation and Organization Development Committees.Committee. He also served on the Board of Directors of Ping Identity Holding Corp., a provider of federated identity management and self-hosted identity access management solutions to web identities and single sign-on solutions, from 2021 until its sale in 2022. Mr. Martin received the 2020 Chicago CIO of the Year Leadership ORBIE Award. In 2017, he was selected to the CIO Hall of Fame by CIO Magazine for IT innovation and business leadership and was recognized in Black Enterprise’s 2017 Most Powerful Executives in Corporate America. In 2014, Mr. Martin was listed among the “100 Diverse Corporate Leaders in STEM” by STEMconnector and has been recognized as a Business Leader of Color by Chicago United.

Key Qualifications, Experience, Skills, and Expertise Contributed to the Board Mr. Martin has extensive management experience across the information technology and cybersecurity industries, which uniquely positions him to significantly contribute to the Board’s oversight of the Company’s cybersecurity framework, management of information security risks, and its information security training program. Mr. Martin’s vast digital strategy knowledge helps enable the Board to assist the Company in achieving its goals through digital initiatives. He also provides valuable insight to the Audit Committee in its responsibility to oversee and manage cybersecurity risks. In addition, the Board benefits from Mr. Martin’s international business experience, which includes employment in leadership positions for several global businesses, as well as service at a foreign location on an assignment abroad.

|

| | |

13

| | | | | | | | |

Committee

Membership(s): Other Public Boards: ••Virtus Investment

Partners, Inc. (Nasdaq: VRTS)

| | Mr. Morris has been President and Chief Investment Officer of The Prairie & Tireman Group, an investment partnership, since 1998. Mr. Morris was formerly Emergency Financial Manager, Inkster, Michigan Public Schools, from 2002 to 2005, and Chief Financial Officer, Detroit, Michigan Public School District, from 1999 to 2000. He is a Certified Public Accountant and Chartered Financial Analyst. Since 2021, Mr. Morris has been a member of the Board of Directors of Virtus Investment Partners, Inc., a publicly traded firm providing investment management and related services to individuals and institutions through independent managers using distinct investment strategies. Mr. Morris is a member of the Audit Committee of the Virtus Board of Directors.Directors of Virtus. Key Qualifications, Experience, Skills, and Expertise Contributed to the Board Mr. Morris brings to the Board deep knowledge of financial controls, audit, reporting, financial planning, and forecasting. As the Company measures its operating and strategic performance by reference to its financial goals, Mr. Morris’ understanding of finance and financial reporting processes are instrumental. The Board also benefits from his leadership of an investment partnership, as well as his service as a director of Virtus, Investment Partners, Inc., which enable him to provide a valuable investor perspective to Board matters. Mr. Morris’ vast experience with capital markets further enables the Board to plan for growth through investment. Mr. Morris’ experience as Chief Investment Officer of an investment partnership, his experience as a Certified Public Accountant, Chartered Financial Analyst, and his knowledge of finance led to his designation as an “audit committee financial expert.”

|

| | |

14

| | | | | | | | |

SUZANNE P. Committee

Membership(s): Other Public Boards: ••Brookfield

Infrastructure Partners (NYSE: BIP)

•Ovintiv, Inc. (NYSE: OVV)

| | Ms. Nimocks was formerly a Director (Senior Partner) with McKinsey & Company, a global management consulting firm, from June 1999 to March 2010, and was with the firm in various capacities since 1989, including as leader of the firm’s Global Organization, Risk Management, and Oil and Gas Electric Power and Renewables (wind, solar, and geothermal) Practices.practices. Ms. Nimocks served on several of the firm’s worldwide personnel committees and formerly served as the Houston Office Manager. Ms. Nimocks has a variety of board leadership experience across industries and geographies. Since 2010, she has served on the boardBoard of Directors of Ovintiv, Inc., a leading North American hydrocarbon exploration and production company, where she chairs the Corporate Responsibility and Governance Committee and is a member of the Audit Committee. She also previously chaired its Human Resources and Compensation Committee. Since August 2022, she has served on the boardBoard of Directors of Brookfield Infrastructure Partners, a global infrastructure company that owns and operates high-quality, long-life assets in the utilities, transport, energy, and data infrastructure sectors. She also currently serves on the Global Advisory Board for Advancing Women Executives. Beginning in 2010 and until 2021, Ms. Nimocks served as a director and chaired the Compensation Committee at Valaris plc, an offshore drilling and well drilling company, and chaired the Environment Health and Safety Committee and Compensation Committee at its predecessor, Rowan Drilling Companies. She also served on the Board of Directors of ArcelorMittal, one of the world’s leading steel and mining companies, from 2011 to 2022, where she was a member of its Appointments, Remuneration, Corporate Governance and Sustainability Committee. Ms. Nimocks also formerly chaired the Environmental Committee of the Greater Houston Partnership.

Key Qualifications, Experience, Skills, and Expertise Contributed to the Board Ms. Nimocks brings a wealth of strategic consulting and corporate development experience to the Board that benefits the Company as it seeks to expand into new product adjacency markets and develop multi-material and prefabricated solutions. She is also skilled in identifying, managing, and mitigating corporate risks and capturing new technological advances applicable to the Company’s strategy of innovation. She gained significant knowledge from specializing in global management consulting and the energy sector. Her experience with renewable energy guides the Board’s commitment to sourcing 100% renewable electricity by 2030 with the goal to fully decarbonize in the future. She is involved in numerous organizations and initiatives in support of environmental and social issues, which directly ties to the Company’s goalmission of building a sustainable future through material innovation. Ms. Nimocks has also led sustainability and inclusion and diversity projects. She counsels the Board in its oversight of the Company’s sustainability and circular economy initiatives. Her service on other public company boards strengthens the Company’s governance principles and provides a unique perspective to its strategic global initiative and sustainability growth strategies.

|

| | |

15

| | | | | | | | |

Committee

Membership(s): • Compensation•

Governance and Nominating

Other Public Boards:

| | Mr. Williams has served as President and Chief Executive Officer of Domtar Corporation, a manufacturer of fiber-based products including communication papers, specialty and packaging papers and absorbent hygiene products, since 2009. In November 2022, Domtar announced that Mr. Williams intends to retire as President and Chief Executive Officer effectivefrom 2009 until June 30, 2023. Mr. Williams will continuecontinues to serve as a part-timean advisor regarding strategic growth opportunities for Domtar. He also served as a member of Domtar’s Board of Directors until Domtar’s sale in 2021. From 2000 to 2008, Mr. Williams served in senior executive positions with SCA Packaging Ltd. and SCA Packaging Europe, which is among Europe’s largest producers of containerboard paper used for the manufacturing of corrugated box products. From 2005 to 2008, he served as President of SCA Packaging Europe, and as regional managing director for its U.K. and Ireland operations from 2000 to 2005. Prior to joining SCA Packaging, Mr. Williams held several increasingly senior positions in sales, marketing, management, and operations with Rexam plc Packaging Resources, Inc., Huhtamaki, Alberto Culver (U.K.) Ltd., and MARS Group. Since April 2018, Mr. Williams has been a director of Form Technologies, Inc., a privately held leading global group of precision component manufacturers, based in Charlotte, North Carolina, where he has also been the non-executive chair of the Board of Directors since January 2019.

Key Qualifications, Experience, Skills, and Expertise Contributed to the Board Mr. Williams brings to the Board significant leadership experience from his former role as President and Chief Executive Officer of Domtar Corporation and previously as a senior executive in the European packaging industry. He developed an in-depth understanding of manufacturing, quality, and logistics serving in these roles. His extensive management experience provides the Board with a valuable perspective on the Company’s global manufacturing and supply chain operations. Mr. Williams’ experience in managing manufacturing businesses gives him valuable insight to assist the Company’s efforts to expand the use of recycled materials in its manufacturing operations and its products, across all businesses. Mr. Williams provides counsel to the Board as it evaluates the Company’s sustainability practices for its operations and supply chains. His significant experience in international business, operations, sales, and marketing also enableenables him to provide the Board with a valuable perspective on the Company’s goals of strengthening its position in core markets and products and expanding into new product adjacencies.

|

| | |

RECOMMENDATION REGARDING PROPOSAL 1:

16

| | | | | | | | | | | |

| | | |

| ü | | The Board of Directors recommends that you vote "FOR" each Director Nominee. | |

| | | |

CORPORATE GOVERNANCE PRACTICES AND HIGHLIGHTS

| | | |

| | | |

•90% of the director nominees are independent •100% independent Audit, Compensation, Finance, and Governance and Nominating Committees •Lead Independent Director with robust and defined responsibilities •Board access to senior management and independent advisors •Executive sessions of independent directors at every regular Board and Committee meeting | | 90% of the director nominees are INDEPENDENT |

|

|

| | | | | | | | |

|

Stockholder Rights and Engagement | | |

| | |

•All members of the Board are elected annually •Annual advisory vote on named executive officer compensation •Majority vote standard in uncontested director elections with mandatory resignation requirement •Robust stockholder outreach program •No stockholder rights plan | | Robust stockholder OUTREACH PROGRAM |

|

| | | | | | | |

| | |

|

Policies and Practices | | |

| | |

•Clawback, anti-hedging, and anti-pledging policies •Annual Board, Chair/CEO, and Committee self-evaluation process (through written assessments and interviews with the Lead Independent Director) and review of management succession plan •Robust stock ownership guidelines: o•Directors: 5x maximum annual cash retainero•Other named executive officers: 3x base salary•Overboarding policy for directors to limit membership on publicly traded company boards (including service on the Company’s Board) o•Employee Directors: No more than two publicly traded company boardso•Non-Employee Directors: No more than four publicly traded company boards o•Audit Committee members: No more than two other publicly traded company audit committees•Mandatory director retirement age of 73 •Global Code of Conduct for employees, officers, and directors | |  Clawback, anti-hedging, and anti-pledging POLICIES |

17

| | | | | | | | |

Board Composition | | |

| | |

•60% gender, ethnic, and racial diversity among director nominees •Additions of five new independent directors since 2014, four of which increased gender, ethnic, or racial diversity (no directors self-identified as members of the LGBTQ+ community) •Women occupy three Board leadership positions (Lead Independent Director, Governance and Nominating Committee Chair, and Audit Committee Chair) •Commitment to include, in each third-party search for independent director candidates, qualified candidates who reflect diverse backgrounds, including diversity of gender or race | |   60% 60%gender, ethnic, and racial diversity among director nominees |

1 Through self-identification in director questionnaires.

18

CORPORATE GOVERNANCE GUIDELINES

Our Board has adopted Corporate Governance Guidelines that, in conjunction with our Amended and Restated Certificate of Incorporation, Bylaws, and Board committee charters, form the framework for our corporate governance. The Governance and Nominating Committee reviews the Corporate Governance Guidelines annually and makes revisions, as necessary. The Corporate Governance Guidelines are published on our website at http://www.owenscorning.comand will be made available in print upon request by any stockholder to the Corporate Secretary of the Company.

DIRECTOR RETIREMENT, REFRESHMENT, AND SUCCESSION

Pursuant to the Corporate Governance Guidelines, the mandatory retirement age for directors is 73. A director who has attained the age of 73 shall not be nominated for reelection at an annual meeting of stockholders.

Under its charter, the Governance and Nominating Committee is responsible for reviewing with the Board the appropriate skills and characteristics of Board members in the context of the current

make-up of the Board. The Governance and Nominating Committee makes recommendations to the Board regarding size and composition of the Board, reviews the suitability of directors for continued service, and is responsible for responding to any concerns of directors relating to the performance of the Board. As part of its refreshment process, the Board seeks to attain a healthy mixture of tenures, including both longer and shorter tenured directors, which can provide a balance of fresh ideas and both Company institutional and market knowledge, alongside experience through the business cycle.

The Governance and Nominating Committee also makes recommendations to the Board regarding the size, composition, and leadership of each standing committee of the Board, and recommends individual directors to fill any vacancy that might occur on a committee. The Governance and Nominating Committee is committed to including, in each third-party search for independent director candidates, qualified candidates who reflect diverse backgrounds, including diversity of gender and race.

Pursuant to the Corporate Governance Guidelines, the Board has the authority to select its Chair based on its collective best judgment as to the candidate best suited to meet the Company’s needs at a given time. Brian D. Chambers serves as the Company’s Board Chair and CEO.

The Board determined that

combiningcontinuing to combine the Chair and CEO positions

allowedallows for clear and consistent leadership on critical strategic objectives and

enabledenables a consistent flow of information for the Board’s oversight of risk. The Board’s prior experience working with Mr. Chambers as President and CEO, as well as his track record of success in over

1920 years with the Company in a variety of leadership positions, strongly supported its conclusion that the Company and its stockholders would be best served with Mr. Chambers leading the Company as its Chair and CEO.

The Board has determined that it is appropriate to have a structure that provides strong leadership among the independent directors of the Board. As discussed below, the independent directors on our Board have elected a Lead Independent Director to serve in a lead capacity to coordinate the activities of the other independent directors and to perform such other duties and responsibilities as the Board may determine. After the

2023 Annual Meeting, Suzanne P. Nimocks

will beginbegan her second

two-year term as Lead Independent Director. Ms. Nimocks has been a director of the Company since 2012, serving as Chair of its Finance Committee from 2015 to 2021, as well as Lead Independent Director and Chair of the Governance and Nominating Committee since 2021. Her previous experience as a senior partner with McKinsey & Company positions her to provide superior oversight of the Company’s global business and strategy. The Company also benefits from her extensive leadership experience on the boards of other global companies and her proven track record on environmental, social, and governance issues.

Additionally, the Board, which consists entirely of independent directors other than Mr. Chambers, exercises an independent oversight function. Each of the Board committees, other than the Executive Committee, is comprised entirely of independent directors. Regular executive sessions of the independent directors are held. On an annual basis, each of the independent directors evaluates the Chair and CEO in several key areas.

The Board has complete access to the Company’s management and believes that its ongoing ability to review the leadership structure of the Board and to make changes as it deems necessary and appropriate gives it the flexibility to meet varying business, personnel, and organizational needs over time.

19

LEAD INDEPENDENT DIRECTOR The responsibilities of the Lead Independent Director, as provided in the Charter of Lead Independent Director for the Company, include:

•presiding at meetings of the Board in the absence of, or upon the request of, the Chair;

•serving as a designated member of the Executive Committee of the Board;

| • | | •presiding over all executive sessions of non-management directors and independent directors and reporting to the Board, as appropriate, concerning such sessions; •non-management directors and independent directors and reporting to the Board, as appropriate, concerning such sessions; |

reviewing and approving Board meeting agendas and schedules in collaboration with the Chair to ensure there is sufficient time for discussion, recommending matters for the Board to consider and advising on the information submitted to the Board by management;

| • | | •serving as a liaison and supplemental channel of communication between the non-management/independent directors and the Chair without inhibiting direct communication between the Chair and other directors; •serving as the principal liaison for consultation and communication between the non-management/independent directors and stockholders; •non-management/independent directors and the Chair without inhibiting direct communication between the Chair and other directors; |

| • | | serving as the principal liaison for consultation and communication between the non-management/independent directors and stockholders;

|

advising the Chair concerning the retention of advisors and consultants who report directly to the Board; and

•in addition to the directors’ annual evaluation of the Board, Chair and CEO, and committees, interviewing all directors regarding the performance of the Board and the directors.

The Charter of Lead Independent Director for the Company is available on our website at http://www.owenscorning.com. The Board evaluates its structure and composition annually and believes that having a strong Lead Independent Director with significant leadership responsibilities, as described above, contributes to effective Board leadership for the Company.

BOARD, COMMITTEE,

AND CHAIR AND CEO EVALUATION PROCESS

Each year, the Governance and Nominating Committee facilitates a process to evaluate the effectiveness of the Board, its committees,

and the Chair and

the CEO.

The Board and its committees complete

self-assessmentself-evaluation questionnaires that

evaluateassess effectiveness in several areas, including composition, structure, and processes. The completed questionnaires are summarized by a third-party law firm to ensure independence and

non-bias in the process. The

non-management directors individually discuss the results with the Lead Independent Director. The Lead Independent Director and committee chairs then review the evaluation results at the Board and committee levels, respectively, to discuss and incorporate feedback. The Governance and Nominating Committee utilizes the results of this robust and thorough process to recommend changes to Board processes, to determine critical skills required of prospective director candidates and to make recommendations for committee assignments.

The Governance and Nominating Committee also prepares and circulates evaluations to the independent directors regarding the performance of the Chair

/and CEO in several key performance areas.

Non-management directors discuss their feedback on the Chair

/and CEO with the Lead Independent Director. The results of the process are discussed in an executive session of the

non-management directors and are also factored into the Compensation Committee’s performance

evaluationsevaluation of the Chair

/and CEO.

The Board oversees the Company’s identification and management of enterprise risks. Some of the Board’s responsibilities for risk oversight processes have been delegated to its relevant committees. A detailed mapping of risk oversight responsibilities of the Board and its committees is reviewed regularly by the Board.

RISK OVERSIGHT RESPONSIBILITIES OF THE BOARD’S COMMITTEES

In addition to facilitating oversight of financial risks, the Audit Committee also has primary responsibility for facilitating the Board’s process of oversight with respect to the Company’s management of key risks generally. Pursuant to its charter, the Audit Committee’s responsibilities include reviewing annually and receiving periodic updates on the Company’s identification of its key risks, major financial exposures, and related mitigation plans.

The Audit Committee is tasked with ensuring that the Board and its committees oversee the Company’s management of key risks and major financial exposures within their respective purviews. The Audit Committee regularly reviews with the Board the mapping of Board and committee responsibilities for risk oversight. The Audit Committee is also responsible for periodically evaluating the effectiveness of the Board’s and its committees’ process of oversight with respect to the Company’s management of key risks.

20

In addition to the Audit Committee, the Compensation, Finance, and Governance and Nominating Committees each review and evaluate risks associated with their respective areas. Each of the Board committees provides reports concerning its respective risk oversight activities to the Board and the Board considers and discusses such reports.

OVERSIGHT OF CYBERSECURITY

RISKRISKS

The Board has delegated responsibility to the Audit Committee for overseeing the cybersecurity risk management strategy for the Company. The Audit Committee receives

regular updates on

our cybersecurity

risksrisk management process from

the Company’smembers of management, including our Chief Information Officer

at least twice per year.(“CIO”). The Audit Committee reviews

how the Company is executing against itsour comprehensive cybersecurity framework, including reviewing

the Company’sour cybersecurity reporting

protocol. From timeprotocol that provides for the notification, escalation and communication of significant cybersecurity events to

time,a crisis management team and appropriate levels of management, including our CIO, as well as to the Audit

Committee may receive additional updates on efforts regarding data loss prevention, regulatory compliance, data privacy, threat and vulnerability management, cyber-crisis management, or other topics, as applicable. In 2023, management began providingCommittee. Management also provides the Audit Committee with a cybersecurity dashboard, which the full Board

of Directors can

access.access as well. Additionally, the Audit Committee regularly provides updates to the Board on the status of the Company’s cybersecurity risk management process.

RISK MANAGEMENT PROCESS

The

Company periodically has external information security assessments performed by third partiesCompany’s enterprise risk management process is designed to

verify our internal assessment resultsidentify, assess and

prioritize the Company’s risk exposures across various time frames, from the short-term to

stay current on information security risks. Over the

past five fiscal years, the Company has on average, completed multiple such assessments per year.long-term. The

Company also maintains an information security training program that encompasses the following areas: phishing and email security, password security, data handling security, cloud security, operational technology (OT) securityCompany’s risk oversight processes and

cyber-incident responsedisclosure controls and

reporting processes. The Company’s security program has historically provided training and information security awarenessprocedures are designed to appropriately escalate key risks to the

following groups of individuals: salaried employees, new hires, people with accessBoard as well as to

confidential information or personal data, operational technology administrators, executives, and cyber-incident responders.Over the last three fiscal years, the Company did not experience any information security breach that had a material impact on its business. The Company does manage minor information security issues from time to time as part of its routine operations.

RISK MANAGEMENT PROCESS

analyze potential risks for disclosure. The Company has a management risk committee (the “Risk Committee”) that is responsible for overseeing and monitoring the Company’s risk assessment and mitigation-related actions. The Risk Committee is not a Board committee; instead, it is a cross-functional committee that includes members across many areas of expertise, including corporate audit, finance, legal, information technology, treasury, and business functions. This internal group identifies risks and mitigation strategies, and it provides key updates to executive officers and the Audit Committee.

We currently have an enterprise risk register and

sub-registers for each of our three businesses, as well as compliance and finance. The Risk Committee uses these individual risk registers to create an enterprise risk register, which enables business units and the Risk Committee to facilitate strategic and operational planning processes while mitigating sustainability and other risks.

The risk registers are also reviewed quarterly by the Audit Committee. Risks are prioritized primarily based on their potential financial impact and the probability of occurrence.

The enterprise risk register is reviewed quarterly by executive management and the Audit Committee.

The Board oversees the Company’s strategy. The Board performs an annual review of the strategic plans for each

major businessreportable segment and for the Company as a whole. Furthermore, in evaluating major investments or other significant decisions, the Board generally considers the Company’s long-term strategic plans and the potential impact on long-term stockholder value.

OVERSIGHT OF

ESGTheSUSTAINABILITY

Oversight, guidance, and direction on sustainability topics — including our 2030 sustainability goals — are provided by the Board,

overseeswho oversee management’s execution of

our sustainability strategy. Our Directors’ Code of Conduct provides that directors are expected to provide oversight, guidance and direction on sustainability issues and opportunities that have potential impact on the

Company’s ESG strategy. The Board performs an annual reviewreputation and long-term economic viability of

ESG matters.the Company. As used in the Directors’ Code of Conduct, the term “sustainability” includes the concepts of: personal safety; environmental compliance; product stewardship; and the environmental and social impact of our global operations and the products we make and sell. In addition, the Compensation, Finance, and Governance and Nominating Committees maintain oversight of management’s responsibilities for particular aspects of

ESGsustainability associated with their respective areas. The Board committees periodically provide reports concerning these

ESG topics to the Board and the Board considers and discusses such reports.

The Company actively engages in succession planning to ensure that it has sufficient depth and breadth of talent. The Board oversees workforce and senior management development primarily through its Compensation and Governance and Nominating Committees. In its oversight of senior management evaluation, development, and compensation, and its evaluation of executive officer performance and determination of executive compensation, the Compensation Committee regularly reviews with management and the Board employee composition, talent, diversity, and senior management development and succession plans. In addition, the Governance and Nominating Committee annually reviews the senior management continuity plan, which addresses contingency planning in the event of an unexpected absence of the CEO. The Board, with the CEO and Chief Human Resources Officer, annually reviews executive talent and succession planning, and regularly reviews management and employee inclusion and diversity programs and initiatives.

21

The CEO presents an annual report on succession planning and evaluation of key executives. The CEO also recommends, and updates as appropriate, a successor to the Board for the CEO position in the event of an unexpected disability of the CEO.

COMMUNICATIONS WITH DIRECTORS

Stockholders and other interested parties may communicate with the Lead Independent Director or any other

non-management director by sending an email to

non-managementdirectors@owenscorning.com. All such communications are promptly reviewed by the General Counsel and/or the Vice President, Internal Audit for evaluation and appropriate

follow-up. The Board has determined that communications considered to be advertisements, or other types of “Spam” or “Junk” messages, unrelated to the duties or responsibilities of the Board, should be discarded without further action. A summary of all other communications is reported to the

non-management directors. Communications alleging fraud or serious misconduct by directors or executive officers are immediately reported to the Lead Independent Director. Complaints regarding business conduct policies, corporate governance matters, accounting controls, or auditing are managed and reported in accordance with the Company’s existing

Audit Committee complaint policy or business conduct complaint

procedure, as appropriate.procedure.

DIRECTOR QUALIFICATION STANDARDS

Pursuant to New York Stock Exchange (“NYSE”) listing standards, our Board has adopted Director Qualification Standards with respect to the determination of director independence that incorporate the independence requirements of the NYSE corporate governance listing standards. The standards specify the criteria by which the independence of our directors will be determined, including strict guidelines for directors and their immediate families with respect to past employment or affiliation with the Company or its independent registered public accounting firm. The full text of our Director Qualification Standards is available on our website at http://www.owenscorning.com. Using these standards, the Board determines whether a director has a material relationship with the Company other than as a director.

With the assistance of legal counsel, the Governance and Nominating Committee reviewed the applicable legal standards for director and Board committee independence, our Director Qualification Standards, and the criteria applied to determine “audit committee financial expert” status. The Governance and Nominating Committee also reviewed reports of the answers to annual questionnaires completed by each of the independent directors and of transactions with director-affiliated entities. On the basis of this review, the Governance and Nominating Committee delivered recommendations to the Board and the Board made its independence and “audit committee financial expert” determinations based upon the Governance and Nominating Committee’s reports and recommendations.

The Board has determined that

9nine of the current

10ten directors are independent. Specifically, directors Cordeiro, Elsner, Festa, Lonergan, Mannen, Martin, Morris, Nimocks, and Williams are independent under the standards set forth in our Director Qualification Standards and applicable NYSE listing standards. Director Chambers is not independent. The Board also has determined that all of the directors serving on the Audit, Compensation, and Governance and Nominating Committees are independent and satisfy relevant requirements of the Securities and Exchange Commission (the “SEC”), the NYSE, the Company, and the respective charters of such committees.

EXECUTIVE SESSIONS OF DIRECTORS Our Corporate Governance Guidelines specify that executive sessions or meetings of

non-management directors without management present must be held regularly (at least three times a year) and at least one such meeting of

non-management directors must include only independent directors. Currently, all of our

non-management directors are independent. In

2022,2023, the

non-management directors met in executive session five times. Our Lead Independent Director presides over all executive sessions of the Board attended by the Lead Independent Director.

THE COMPANY’S POLICIES ON BUSINESS ETHICS AND CONDUCT

CODE OF BUSINESS CONDUCT POLICY All of our employees, including our CEO, Chief Financial Officer, and Controller, are required to abide by the Company’s Code of Business Conduct Policy to ensure that our business is conducted in a consistently legal and ethical manner. This policy forms the foundation of a comprehensive process that includes compliance with all corporate policies and procedures, an open relationship among colleagues that contributes to good business conduct and the high integrity level of our employees. Our policies and procedures cover all areas of professional conduct, including employment policies, conflicts of interest, intellectual property, and the protection of confidential information, as well as strict adherence to laws and regulations applicable to the conduct of our business. Employees are expected to report any conduct that they believe to be an actual or apparent violation of the Company’s Policies on Business Ethics and Conduct. In addition, the Company maintains a reporting system with access available on an anonymous basis online, by email, or by telephone, and the Code of Business Conduct and reporting system are translated into multiple languages to ensure all our employees around the globe can

readunderstand it and report any violations in their primary languages.

22

ETHICS POLICY FOR CHIEF EXECUTIVE AND SENIOR FINANCIAL OFFICERS The Company has adopted an Ethics Policy for Chief Executive and Senior Financial Officers that applies to our Chief Executive Officer, Chief Financial Officer, and Controller (“Senior Financial Officers”), which provides, among other things, that Senior Financial Officers must comply with all laws, rules, and regulations that govern the conduct of the Company’s business and that no Senior Financial Officer may participate in a transaction or otherwise act in a manner that creates or appears to create a conflict of interest unless the facts and circumstances are disclosed to and approved by the Governance and Nominating Committee or Audit Committee, as appropriate. Suspected violations of this policy also are expected to be reported through the anonymous reporting system described above.

The Sarbanes-Oxley Act of 2002 requires audit committees to have procedures to receive, retain, and treat complaints received regarding accounting, internal accounting controls, or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. We have adopted and comply with such procedures.

DIRECTORS’ CODE OF CONDUCT

Our directors are required to comply with a Directors’ Code of Conduct, which is intended to focus the Board and the individual directors on areas of ethical risk, help directors recognize and deal with ethical issues, provide mechanisms to report unethical conduct, and foster a culture of honesty and accountability. This code covers all areas of professional conduct relating to service on the Board, including conflicts of interest, unfair or unethical use of corporate opportunities, strict protection of confidential information, compliance with all applicable laws and regulations, sustainability and oversight of ethics, and compliance by employees of the Company.

ACCESS TO COMPANY POLICIES

The full texts of our Code of Business Conduct Policy, Ethics Policy for Chief Executive and Senior Financial Officers and Directors’ Code of Conduct are published on our website at http://www.owenscorning.com and will be made available in print upon request by any stockholder to the Corporate Secretary of the Company. To the extent required by applicable SEC rules or NYSE listing standards, we intend to post any amendments to or waivers from the Ethics Policy for Chief Executive and Senior Financial Officers to our website in the section titled “Corporate Governance.”

BOARD AND COMMITTEE MEMBERSHIP

Our business, property, and affairs are managed under the direction of our Board. Members of our Board are kept informed of our business through discussions with our CEO, Chief Financial Officer, and other officers and employees, by reviewing materials provided to them, by visiting our offices and plants, and by participating in meetings of the Board and its committees. Board members are expected to regularly attend Board and committee meetings as well as our Annual Meetings of Stockholders, unless an emergency prevents them from doing so. Each of our director nominees for the

20222023 Annual Meeting of Stockholders was present at such meeting.

During

2022,2023, the Board met

fiveeight times. Each of our directors attended all of the

regularly scheduled meetings of the Board and committees on which he or she served. The chart below shows committee membership, including those directors who serve as chair of a committee.

| | | | | | | | | | |

NAME | | AUDIT | | COMPENSATION | | EXECUTIVE | | FINANCE | | GOVERNANCE AND NOMINATING |

Cordeiro(1) | | | | X | | X | | C | | |

Elsner(1) | | X | | | | | | X | | |

Festa(1) | | | | X | | | | X | | |

Lonergan(1) | | | | C | | X | | | | X |

Mannen(1) | | C | | | | X | | | | X |

Martin(1) | | X | | | | | | X | | |

Morris(1) | | X | | | | | | X | | |

Nimocks(1)(2) | | | | | | X | | | | C |

Williams(1) | | | | X | | | | | | X |

Chambers | | | | | | C | | | | |

2022 Meetings | | 8 | | 5 | | - | | 4 | | 5 |

| | | | | | | | | | | | | | |

C | | = Committee Chair | | X | | = Committee Member | | 1 | | = Independent | | 2 | | = Lead Independent Director |

23

| | | | | | | | | | | | | | | | | |

| NAME | AUDIT | COMPENSATION | EXECUTIVE | FINANCE | GOVERNANCE AND NOMINATING |

| Cordeiro(1) | | X | X | C | |

| Elsner(1) | X | | | X | |

| Festa(1) | | X | | X | |

| Lonergan(1) | | C | X | | X |

| Mannen(1) | C | | X | | X |

| Martin(1) | X | | | X | |

| Morris(1) | X | | | X | |

| Nimocks(1)(2) | | | X | | C |

| Williams(1) | | X | | | X |

| Chambers | | | C | | |

| 2023 Meetings | 8 | 6 | - | 4 | 4 |

| | | | | | | | | | | | | | | | | | | | | | | |

| C | = | Committee Chair | X | = | Committee Member | (1) = Independent | (2) = Lead Independent Director |

Each of the standing committees of our Board acts pursuant to a charter that has been approved by our Board. These charters are updated periodically and can be found on the Company’s website at http://www.owenscorning.com and will be made available in print upon request by any stockholder to the Corporate Secretary of the Company.

DIRECTOR SERVICE ON OTHER PUBLIC BOARDS (OVERBOARDING POLICY)

The Corporate Governance Guidelines state that directors who are employed full time as executives shall not serve on more than two publicly traded company boards (including service on the Company’s Board) and other directors shall not serve on more than four boards of publicly traded companies (including service on the Company’s Board). This is to ensure that our directors devote adequate time for preparation and attendance at Board and committee meetings, including the Annual Meeting of Stockholders.

The Company’s Audit Committee Charter states that no director may serve as a member of the Audit Committee if such director serves on the audit committees of more than two other publicly traded companies, unless the Board determines that such simultaneous service would not impair the ability of such director effectively to serve on the Audit Committee. The Corporate Governance Guidelines also state that directors should provide notice and submit a letter of resignation prior to assuming significant new job responsibilities or accepting positions on additional public or private company boards. The director’s letter of resignation is then considered by the Governance and Nominating Committee. As such, the Board maintains processes to review and approve directors’ membership on additional public company boards, even if those directors are still within the overboarding limits mentioned above.

Our Board believes that each of our directors, including each of our director nominees, has demonstrated the ability to devote sufficient time and attention to Board duties and to otherwise fulfill the responsibilities required of directors. However, we understand that certain institutional investors may deem Ms. Mannen overboarded based on her role as

chief financial officerPresident at Marathon Petroleum Corporation (“MPC”) and her service on the board

of directors of MPLX GP LLC (“MPLX”) in addition to her service on our Board. MPLX is a

wholly ownedwholly-owned subsidiary of MPC and

MPC is the general partner and majority owner of MPLX LP, a publicly traded limited partnership. Due to tax efficiencies, the MPC/MPLX structure has been in place for over a decade and the underlying business is highly integrated. Ms. Mannen’s MPLX board membership is integral to her role as

chief financial officerPresident at MPC. Thus, we do not view Ms. Mannen’s service on the MPLX board as an additional board obligation, but an extension of her role as

chief financial officer.President. Accordingly, our Board does not believe that Ms. Mannen’s other commitments limit her ability to devote sufficient time and attention to her duties as a director of the Company.

24

| | |

THE AUDIT COMMITTEE |

RESPONSIBILITIES

Maryann Mannen (Chair) | Adrienne Elsner | Paul Martin | Howard Morris |

The Audit Committee is responsible for preparing the Audit Committee report required by SEC rules and assisting the Board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, auditing, financial reporting, internal control, and legal compliance functions of the Company, including assisting the Board’s oversight of:

• the integrity of the Company’s financial statements;

• the Company’s compliance with legal and regulatory requirements;

• the Company’s independent registered public accounting firm’s qualifications and independence; and

• the performance of the independent registered public accounting firm and the Company’s internal audit function.

The Board has determined that directors Mannen, Elsner, and Morris are qualified as audit committee financial experts within the meaning of SEC regulations and that directors Mannen, Elsner, Martin, and Morris are financially literate within the meaning of the NYSE listing standards. All directors serving on the Audit Committee are independent.

RESPONSIBILITIES |

The Audit Committee is responsible for preparing the Audit Committee report required by SEC rules and assisting the Board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, auditing, financial reporting, internal control, and legal compliance functions of the Company, including assisting the Board’s oversight of:

•the integrity of the Company’s financial statements;

•the Company’s compliance with legal and regulatory requirements;

•the Company’s independent registered public accounting firm’s qualifications and independence; and

•the performance of the independent registered public accounting firm and the Company’s internal audit function.

The Board has determined that directors Mannen, Elsner, and Morris are qualified as audit committee financial experts within the meaning of SEC regulations and that directors Mannen, Elsner, Martin, and Morris are financially literate within the meaning of the NYSE listing standards. All directors serving on the Audit Committee are independent.

| | |

|

AUDIT COMMITTEE REPORT |

The Audit Committee has reviewed and discussed the audited financial statements of the Company contained in the Annual Report on Form 10-K with management. The Audit Committee has discussed with PricewaterhouseCoopers LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from PricewaterhouseCoopers LLP per the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with PricewaterhouseCoopers LLP its independence.

Based on the review and discussions referred to in the preceding paragraph, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, for filing with the SEC.

By the Audit Committee:

Maryann T. Mannen, Chair

Adrienne D. Elsner

Paul E. Martin

W. Howard Morris

|

25

The Audit Committee has reviewed and discussed the audited financial statements of the Company contained in the Annual Report on Form 10-K with management. The Audit Committee has discussed with PricewaterhouseCoopers LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from PricewaterhouseCoopers LLP per the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with PricewaterhouseCoopers LLP its independence.

Based on the review and discussions referred to in the preceding paragraph, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, for filing with the SEC.

By the Audit Committee:

Maryann T. Mannen, Chair

Adrienne D. Elsner

Paul E. Martin

W. Howard Morris

| | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee selected PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for

2023,2024, subject to ratification by our stockholders.

| | |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

The aggregate fees billed and services provided by PricewaterhouseCoopers LLP for the years ended December 31,

20222023 and

20212022 are as follows (in thousands):

| | | |

| | | 2022 | | | 2021 | |

| 2023 | |

| | |

Audit Fees (1) | | $ | 5,523 | | | $ | 4,680 | |

| | |

| Audit Fees (1) | |

| | Audit Fees (1) | |

Audit-Related Fees (2) | | | 6 | | | | 0 | |

| | |

| Audit-Related Fees (2) | |

| Audit-Related Fees (2) | |

Tax Fees (3) | | | 525 | | | | 419 | |

| | |

| Tax Fees (3) | |

| Tax Fees (3) | |

All Other Fees (4) | | | 8 | | | | 9 | |

| | |

| All Other Fees (4) | |

| All Other Fees (4) | |

| TOTAL FEES | | $ | 6,062 | | | $ | 5,108 | |

| TOTAL FEES | |

| TOTAL FEES | |

(1)Fees for each of the years ended December 31, 20222023 and 2021,December 31, 2022, consist of the audit of the Company’s consolidated financial statements including effectiveness of internal controls over financial reporting, reviews of the Company’s quarterly financial statements, subsidiary statutory audits, consents and comfort letters, and agreed-upon procedures related to reports filed with regulatory agencies. (2)Audit-related fees consist of attestation services. (3)Tax fees consist of compliance, consulting, and transfer pricing services. (4)All other fees consist of accounting research and disclosure software licenses. It is the Company’s practice that all services provided by its independent registered public accounting firm be

pre-approved either by the Audit Committee or by the Chair of the Audit Committee pursuant to authority delegated by the Audit Committee. No part of the independent registered public accounting firm services related to the Audit-Related Fees, Tax Fees, or All Other Fees listed in the table above was approved by the Audit Committee pursuant to the exemption from

pre-approval provided by paragraph (c)(7)(i)(C) of Rule

2-01 of Regulation

S-X.26

| | |

THE COMPENSATION COMMITTEE |

Edward Lonergan (Chair) | Eduardo Cordeiro | Alfred Festa | John Williams |

RESPONSIBILITIES |

The Compensation Committee is responsible for oversight of the Company’s executive compensation, including authority to determine the compensation of the executive officers, and for producing an annual report on executive compensation in accordance with applicable rules and regulations. The Compensation Committee may delegate power and authority to subcommittees of the Compensation Committee as it deems appropriate. However, the Compensation Committee may not delegate to a subcommittee any power or authority required by any law, regulation, or listing standard required to be exercised by the Compensation Committee as a whole. The Compensation Committee has the sole authority to retain or terminate a compensation consultant to assist the Compensation Committee in carrying out its responsibilities, including sole authority to approve the consultant’s fees and other retention terms. The consultant’s fees will be paid by the Company.

The Compensation Committee also reviews the Company’s executive compensation programs on a continuing basis to determine that they are properly integrated and that payments and benefits are reasonably related to executive and Company performance and operate in a manner consistent with that contemplated when the programs were established.

The Compensation Committee also reviews the compensation of the Company’s directors, including an evaluation of how such compensation relates to director compensation of companies of comparable size, industry, and complexity and, if the Compensation Committee deems it appropriate, adopts or proposes to the Board for consideration, any changes to compensation.

In overseeing the Company’s policies concerning executive compensation for officers, the Compensation Committee:

•reviews at least annually the goals and objectives of the Company’s executive compensation plans and amends, or recommends that the Board amend, these goals and objectives if the Compensation Committee deems it appropriate;

•reviews at least annually the Company’s executive officer compensation plans in light of the Company’s goals and objectives, and, if the Compensation Committee deems it appropriate, adopts or recommends to the Board the adoption of new, or the amendment of existing, executive compensation plans;

•evaluates annually the performance of the CEO in light of the goals and objectives of the Company’s executive compensation plans and, either alone as a committee or together with the other independent directors, sets the CEO’s compensation level based on this evaluation;

•in consultation with the CEO, approves the pay structure, salaries, and incentive payments of all other executive officers of the Company, as well as the funding level of the Company’s annual and long-term incentive plans; and

•reviews and approves any severance or termination arrangements to be made with any executive officer of the Company.